Key Points

Over the last year, few stocks have done better than Micron Technology (NASDAQ: MU).

The leading memory-chip maker is up more than 300%, largely because it’s benefiting from a generational shortage of memory chips from the AI boom. High-bandwidth memory (HBM) chips, which run alongside GPUs to power AI applications, are in high demand, and the supply and-demand dynamics of memory chips have driven a surge in Micron’s revenue and profits.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

For its fiscal 2026, which ends in August 2026, analysts now expect Micron’s revenue to double to $75.4 billion and for adjusted earnings per share to quadruple to $33.38, giving the stock a forward P/E of just 12.

Image source: Getty Images.

A memory supercycle

What’s happening in the memory subsector, which has driven surges in other memory stocks like SK Hynix, Samsung, and Sandisk, is a supercycle.

Memory chips are prone to boom-and-bust cycles as prices for the components can swing widely based on demand and inventory, which fluctuates in the sector from gluts to shortages. Capital costs are intense in the semiconductor industry, which means manufacturers will run their fabs as long as they can earn a gross profit, even if it means overhead costs will lead to losses on the bottom line.

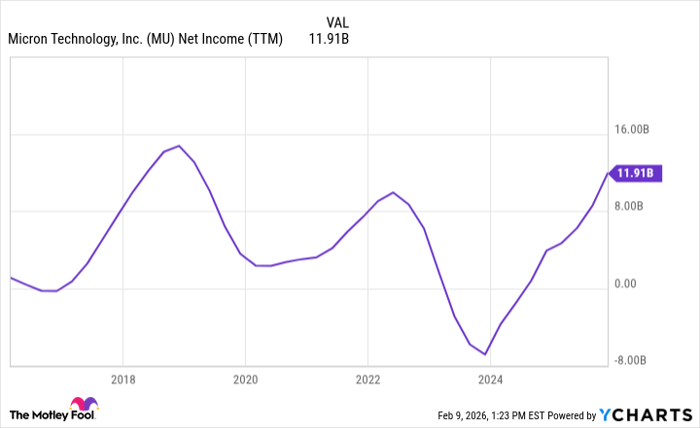

As you can see from the chart below, over the last 10 years, Micron has already been through multiple cycles with its net loss falling as low as nearly $8 billion on a trailing-twelve-month basis in the post-pandemic bust.

MU Net Income (TTM) data by YCharts

However, Micron now seems well on its way to record profits, with analysts estimating net income of roughly $35 billion for the current fiscal year and expecting profits to continue rising at least through 2027.

What history says about the memory cycle

As you can see from the chart above, past memory cycles have been relatively short for Micron, with trough-to-peak or peak-to-trough periods of just a couple of years.

The highest peak you see above, at nearly $16 billion in net income, was by far Micron’s largest profit in its history. At the peak of its profit that cycle, which was driven in part by cloud computing, Micron had a trailing price-to-earnings ratio of just around 3, as the share price had already peaked.

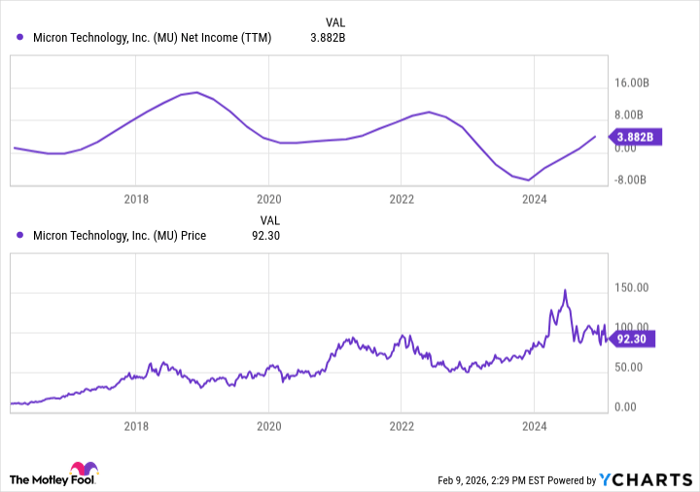

Since stock prices are forward-looking, the cycles in Micron stock tend to run ahead of the profit cycles. In the chart below, which ends a year ago before Micron’s share price went off the charts, you can see how the inflection in the share price typically runs ahead of the directional changes in profit.

MU Net Income (TTM) data by YCharts

As for Micron’s returns, from trough to peak during its cycles, the stock has historically gained about 600% in its last 20 years, as the table shows.

Trough date

Peak date

Trough price

Peak Price

% Gain

11/2008

4/2011

$1.59

$11.95

651%

5/2012

12/2014

$5.00

$36.50

630%

5/2016

5/2018

$9.35

$64.66

591%

12/2018

1/2022

$29.00

$98.45

239%

12/2022

???

$48.43

$455.50 (so far)

840% (so far)

As you can see, Micron has already exceeded the typical trough-to-peak gain.

Why this time could be different

Despite the historical pattern in the memory cycle, the current boom has some elements that are unique to it. Those include the unprecedented levels of capital expenditures from hyperscalers like Amazon, Microsoft, Alphabet, and Meta Platforms, who together are planning to spend upward of $600 billion on capex this year, much of it devoted to AI infrastrucuture, signaling continued strong demand for memory, as well as favorable supply demand dynamics, which are evident in analyst forecasts showing memory prices are expected to continue going up this year.

Several big tech companies, including Apple and Alphabet, have commented on the shortage, and it’s expected to impact the smartphone industry significantly this year.

It takes time for new capacity to come online, so the shortage on the supply side won’t be easily addressed, and the race in AI seems likely to feed demand for the foreseeable future.

The memory cycle will eventually peak like those in the past, but that could still be years away. In the meantime, Micron looks like a smart way to play the AI boom as its profits should soar through at least the next year. If AI sentiment remains strong, the stock could still double before the peak is in, which would bring it close to $800 a share.

However, investors should be aware of the cyclical history in memory. Given the recent stock surge and the more-than-300% gain in a year, the sell-off could be brutal when the cycle eventually turns.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $439,362!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,164,984!*

Now, it’s worth noting Stock Advisor’s total average return is 918% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 10, 2026.

Jeremy Bowman has positions in Meta Platforms and Micron Technology. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Micron Technology, and Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.